Big Picture and Key Takeaway

3rd Quarter 2024

(Click here for Printable PDF)

Key Takeaway

In a reversal of the trend of a handful of large US tech stocks essentially driving the stock markets’ performance for much of the year, the market rally broadened in the 3rd quarter, with value stocks, small companies, and international stocks leading the way while mega-sized US tech companies trailed.

Domestically, US Small-cap stocks led the charge (R2000 +9.3%), while US Large-cap stocks continued to produce a healthy return (S&P 500 +5.9%) in the third quarter. Globally, international stocks outperformed the US as developed international stocks increased (MSCI EAFE +7.3%) and emerging market stocks rallied (MSCI EM +8.7%). The broad-based bond market also increased sharply (AGG +5.2%) due to a steep decline in interest rates in anticipation of the Fed’s delivered September rate cut. Lastly, gold continued its strong run in 2024 by gaining 12.9% for the quarter.

Against the backdrop of a stabilizing economic landscape, the third quarter was marked by significant developments in monetary policy. The Federal Reserve took center stage with a pivotal decision in September, reducing the federal funds rate by 50 basis points, the first cut since 2020, bringing the rate down to a range of 4.75% to 5%. The decision to cut by 50 basis points, rather than a more typical 25 basis points, was driven by the Fed's greater confidence in achieving its inflation targets and mitigating economic risks.

The ideal scenario for the Fed remains a "soft landing," where inflation eases, economic growth remains positive, and interest rates are reduced. The larger rate cut is clearly an attempt by the Fed to “stick the landing” on the economy and get ahead of a potential labor market slowdown with inflation trending towards the Fed’s desired target of 2%. Overall, financial markets have reacted positively to the three-pronged trajectory of inflation decelerating and lower interest rates along with the hope for continued economic growth – a “goldilocks” outcome if there ever was one and rare by historical standards outside of the mid-1990s when it was pulled off by Alan Greenspan & Company.

That said, the threats to this outlook remain the same and two-pronged:

• The Fed is Too Late – In this scenario, the Fed has waited too long to cut rates, keeping borrowing costs too high for too long, consumers reduce spending, and the labor market cools significantly as businesses lay off workers, leading to a slowdown in economic demand and growth.

• The Fed is Too Early – By cutting rates with positive economic growth and strong financial markets, additional economic demand may potentially re-ignite inflation before the “mission” of lowering inflation has been truly accomplished.

Throw in the uncertainty of an election cycle, wars in Europe and the Middle East, and a Chinese economy that needed to be propped up with a massive stimulus package; investors will have plenty to consider and navigate as they hope the “soft landing” becomes a reality.

The Big Picture

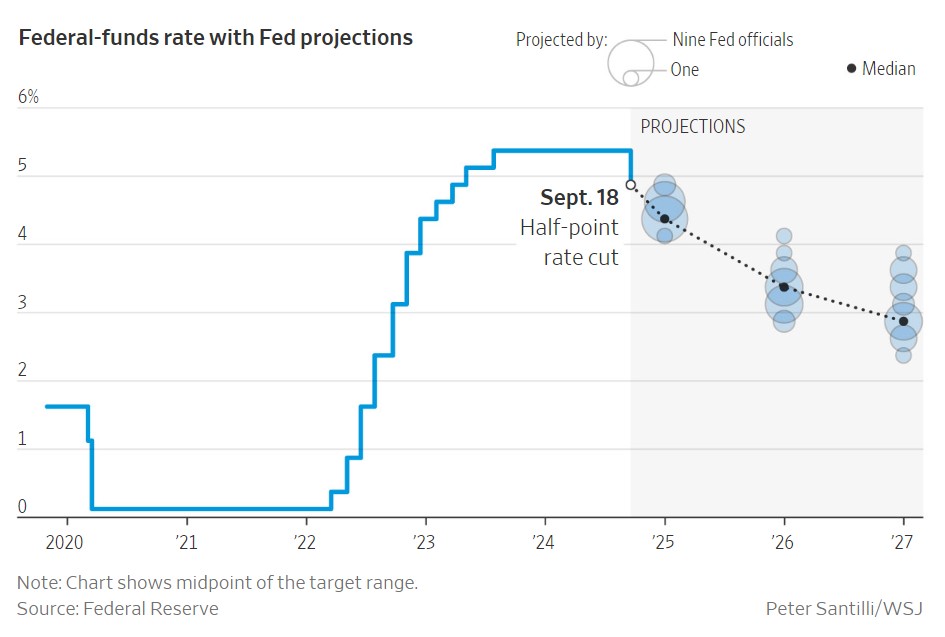

Third-quarter economic data supported the Fed’s ideal “soft landing” scenario. While inflation moderated, economic growth and job creation continued. As the chart (below) indicates, the Fed’s projections currently see the Fed Funds Rate dropping to around 3.5% by the end of 2025, implying another 1.25-1.50% in cuts between now and then.

INFLATION: In September, the Bureau of Labor Statistics announced that the Consumer Price Index for All Urban Consumers (CPI-U) increased by 0.2% from August on a seasonally adjusted basis. Core inflation (all items less food and energy) rose by 0.3% month-over-month. The year-over-year rates were 2.4% (CPI-U) and 3.3% (Core), from 2.5% and 3.2%, respectively, in August. In general, while the headline number (year-over-year) continued to moderate, the results were slightly higher than expected. Food costs were a primary driver of the higher-than-expected reading. On a positive note, shelter costs, which make up more than one-third of the index's weight, showed signs of moderating in September.

GROWTH (Gross Domestic Product): Real gross domestic product increased at an annual rate of 3.0% in the second quarter of 2024, according to the "third" estimate released by the U.S. Bureau of Economic Analysis. The increase in real GDP primarily reflected increases in consumer spending, private inventory investment, and nonresidential fixed investment. Compared to the first quarter, the acceleration in real GDP in the second quarter primarily reflected an upturn in private inventory investment and an acceleration in consumer spending. Looking ahead to the 3rd quarter of 2024, the Federal Reserve Bank of Atlanta's GDPNow forecasting model predicts an annualized growth rate of 3.2%.

JOBS: The September 2024 jobs report revealed another increase in employment, with nonfarm payroll employment rising by 254,000 jobs and far surpassing expectations – with the July and August numbers also revised higher. The unemployment rate declined to 4.1% from 4.2% after having moved steadily higher in recent months. Notably, the recent pickup in September was accompanied by a slight acceleration in the pace of wage growth, which reversed a trend of wage moderation. Wages increased by 4% year-over-year, higher than economists expected.

EARNINGS and ESTIMATES: As of October 4th, research firm FactSet reported that for Q3 2024, the estimated (year-over-year) earnings growth rate for the S&P 500 was projected to be 4.2%, slightly down from where the estimate stood on June 30th. Although that would mark the fifth straight quarter of per-share positive earnings growth year-over-year, it would be a slowdown from the second quarter and the first quarter. Net profit margins for S&P 500 companies are expected to come in at 12.1% for the third quarter, according to the FactSet report. That margin forecast is close to the historic heights seen in 2021, and it is above the five-year average of 11.5%, the report said. The 12.1% estimate - likely driven by price increases, layoffs, and budget tightening - reflects a bigger priority for controlling expenses as economic uncertainty prevails.

RATES AND THE FED: At the September meeting, the Federal Reserve moved to cut interest rates by 50 basis points, lowering the federal funds rate to a range of 4.75%–5.00%. This was the Fed’s first rate cut in over four years, signaling a strategic pivot to support the job market and stimulate economic growth as inflation shows signs of moderation. The decision follows a 14-month period of elevated rates that peaked at 5.25%, marking a significant shift in policy direction. Chairman Jerome Powell highlighted that the cut is aimed not only at managing inflation but also at reinforcing the job market's resilience. Markets are anticipating additional rate cuts in November and December. As Powell noted, "We have gained greater confidence that inflation is moving toward 2%," but risks to the broader economy remain.

Market Performance

Global Stocks

For the 3rd quarter, 35 of the 36 developed markets tracked by MSCI were positive. And of the 40 developing markets tracked by MSCI, 33 were also positive.

• In the U.S., large companies underperformed small companies for the quarter, and value stocks beat growth stocks.

• Only 1 of the 11 S&P 500 sectors delivered a negative return.

o The interest rate-sensitive Real Estate, Utility, and Financials sectors performed best for the quarter, along with a strong showing from the Materials sector.

o The Energy sector delivered the lone negative return, given a large decline in oil prices in Q3.

• Developed and developing international stocks posted strong gains in the third quarter, outpacing the S&P 500. The outperformance was helped by a decline in the U.S. dollar – which is a tailwind for international stock performance.

• China was the major market winner as it enacted a massive stimulus package to support its struggling economy late in the quarter.

Bonds

The bond market posted a strong positive return as bond interest rates decreased significantly. The highlights include the following:

• The 10-year Treasury bond yield decreased by 0.58% for the quarter, leading to a strong increase in the U.S. Treasury market as the market priced in larger Fed rate cuts than were expected to start the quarter.

• Treasury Inflation-Protected Securities underperformed standard Treasuries to post modest positive returns, as inflation expectations declined along with more moderate inflation data.

• U.S. mortgage-backed securities delivered solid returns relative to other sectors, given their shorter duration and very attractive yields relative to other credit sectors.

• Credit spreads, a measure of the bond market's default risk, declined slightly for the quarter. In a reversal of recent trends, the highest credit quality bonds provided higher returns than lower credit quality bonds, the latter of which have higher income payments due to their inferior credit quality.

• The Municipal market underperformed its taxable bond market counterparts as yields on municipal bonds decreased less than equivalent maturity Treasury Bonds.

Important Disclosure Information

This report is provided as information and commentary regarding the market. The views expressed in this report are as of the date of the report, and are subject to change based on market and other conditions. This report contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Please note that nothing in this report post should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be, investment, accounting, tax or legal advice. If you would like investment, accounting, tax or legal advice, you should consult with your own financial advisors, accountants, or attorneys regarding your individual circumstances and needs. Advice may only be provided by AtwoB after entering into an investment advisory or financial planning agreement. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment and/or planning advice from AtwoB. If you are an AtwoB client, please remember to contact AtwoB, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not a guarantee of future returns. Investing involves risk and possible loss of principal capital. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by AtwoB, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of any fees or expenses, transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices and/or categories.

AtwoB is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the AtwoB's current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.

Index and Category Definitions

The S&P 500 Index is a capitalization-weighted index of 500 U.S. stocks. Russell 2000 TR USD is a market cap weighted index The Russell 2000 measuring the performance of approximately 2,000 smallest-cap American companies The MSCI All Country World ex-USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI All Country World ex-USA Index consists of 22 developed and 24 emerging market country indices. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI Emerging Markets (E.M.) Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of 24 emerging markets countries. Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds. ICE BofAML U.S. High Yield Index is an unmanaged index of below-investment grade U.S. corporate bonds. XZU Gold Spot $/Oz reflects the exchange rate of Gold against the U.S. dollar index.