Big Picture and Key Takeaway

2nd Quarter 2024

(Click here for Printable PDF)

Key Takeaway

Following a strong performance in the first quarter (S&P 500 +10.6%) of 2024, U.S. Large cap stocks continued to produce gains in the 2nd quarter (S&P 500 +4.3%). During the quarter, international performance was a mixed bag, as developed international stocks declined (MSCI EAFE -0.4%), but emerging market stocks rallied (MSCI EM +5.0%). The broad-based bond market was basically flat during the quarter (AGG +0.07%) despite a modest rise in interest rates. The U.S. stock market rally continues to be highly concentrated among a handful of the largest companies, with Nvidia alone accounting for nearly one-third of the S&P 500’s total return in the first half.

As we reach the mid-point of 2024, the overall economy has been resilient, which is a positive outcome, but inflation remains a concern. The Federal Reserve has aimed to reduce interest rates to a more neutral level but has delayed doing so until inflation shows consistent moderation. In late 2023, the Fed indicated a “pivot” from "higher for longer" to "lower from now on" for interest rates, which surprised the markets. The pivot caused a sharp drop in long-term interest rates, a significant rally in the stock market, eased lending conditions, and increased overall financial activity.

Recently, however, the labor market and wage growth have shown signs of cooling. The last few months of inflation readings have also provided some relief, as the headline data has resumed marching lower towards the Fed’s target of 2%. More evidence is likely needed for the Fed to be confident in achieving this goal. After the latest jobs and inflation reports, markets currently estimate a 94% chance of a rate cut by September and similar odds of at least two rate cuts by the end of the year.

The ideal scenario for the Fed is a "soft landing," where inflation eases, economic growth remains positive, and interest rates are cut moderately as inflation concerns ease. Two less favorable scenarios are:

- Hard Landing: Economic growth turns negative, inflation drops, and interest rates are cut significantly.

- Stubborn Inflation: The economy continues to grow, but inflation remains high, forcing the Fed to keep interest rates elevated for longer.

While the economy’s ultimate destination remains highly uncertain, hope remains that the Fed can “thread the needle” and avoid the less favorable outcomes. We believe the market’s expectations have shifted from a recession in 2022 to a soft landing in 2023, a view that remains generally held through mid-2024. However, the markets remain vulnerable if economic results deviate from this consensus and trend toward either a recession or persistent inflation. Given these uncertainties, we are focusing on undervalued, higher-quality investments in stocks and bonds while benefiting from the diversification offered by real assets and alternative investments.

The Big Picture

Overall, the second quarter produced economic data that somewhat supported the Fed’s ideal “soft landing” scenario. Inflation moderated somewhat after being stubbornly elevated in the first quarter. Economic growth was positive but not overheating. Job creation was strong but showed some signs of cooling along with wage growth. Earnings growth for stocks is projected to be robust for the second quarter, although slightly less than expected three months ago. All in all, the Fed maintains its wait-and-see approach to monetary policy, buying them more time to assess additional data over the following months.

INFLATION: In June, the Bureau of Labor Statistics announced the Consumer Price Index for All Urban Consumers (CPI-U) decreased by 0.1% from May on a seasonally adjusted basis. Core inflation (all items less food and energy) rose by 0.1% month-over-month. The year-over-year rates were 3.0% (CPI-U) and 3.3% (Core), from 3.3% and 3.4%, respectively in May. Of note, housing costs, which have been stubbornly high and are a significant component of the overall inflation calculation, trended in the right direction as they rose 5.2 percent from a year earlier. That’s the slowest pace of year-over-year growth since 2022, down from a peak of more than 8 percent early last year.

GROWTH: (Gross Domestic Product): In the first quarter of 2024, the U.S. GDP grew at an annual rate of 1.4%, a decrease from the 3.4% growth seen in the fourth quarter of 2023. Compared to the fourth quarter, the deceleration in real GDP primarily reflected slowdowns in consumer spending, exports, state and local government spending, and a downturn in federal government spending. An acceleration in residential fixed investment partly offset these movements. Looking ahead to the 2nd quarter of 2024, the Federal Reserve Bank of Atlanta's GDPNow forecasting model predicts an annualized growth rate of 2%.

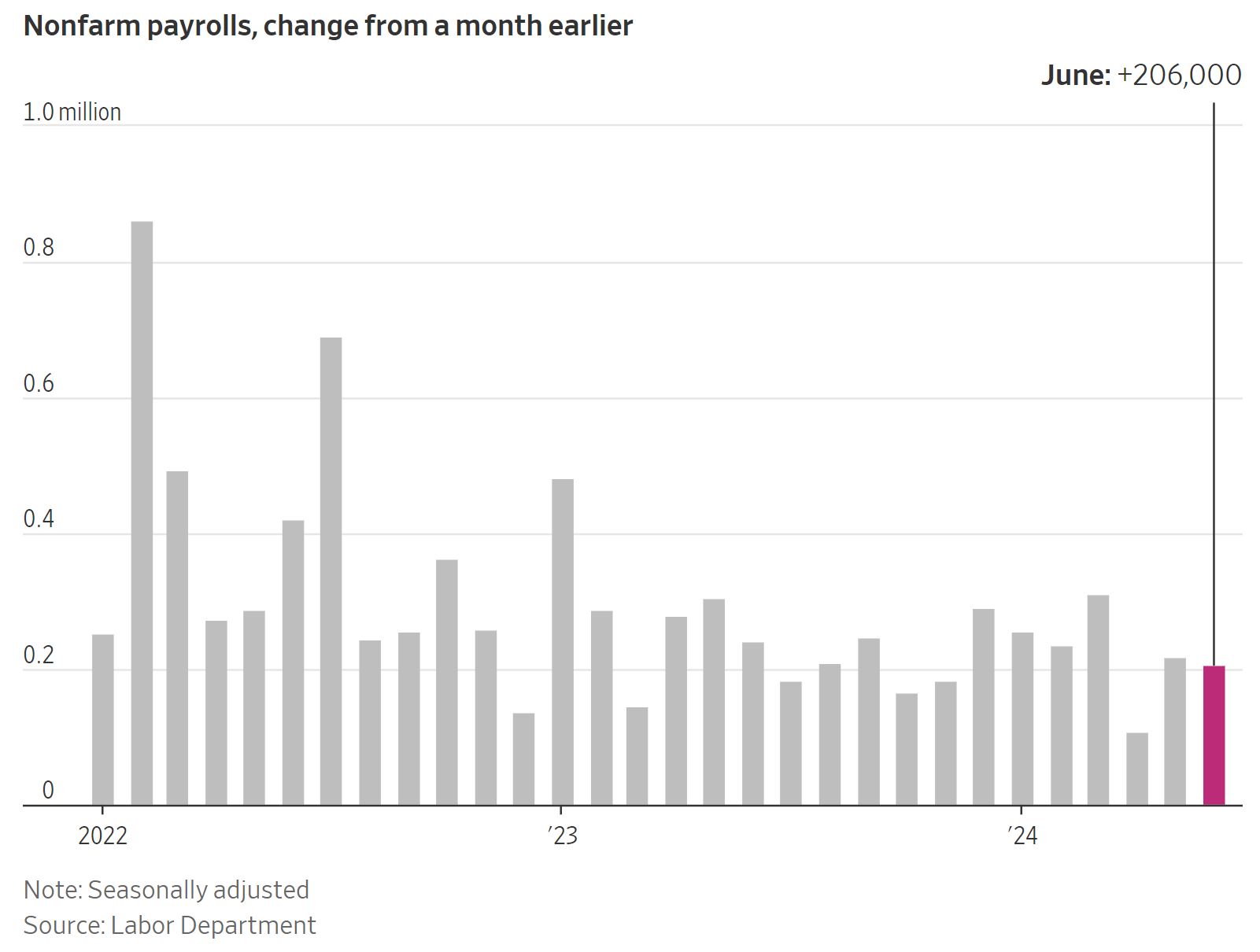

JOBS: The June 2024 jobs report revealed another increase in employment, with nonfarm payroll employment rising by 206,000 jobs for the 41st straight month of gains. While June produced another solid increase in jobs, the number was down from 218,000 in May, and the three-month moving average has cooled to 177,000. The unemployment rate increased to 4.1% from 4% in May, still hovering near 50-year lows but at the highest level since November 2021. Notably, the recent cooling of labor in June was accompanied by a slowing of the pace of wage growth. Wages increased by 3.9% year-over-year, the lowest rate since June 2021. A continued slowdown in wage growth might alleviate some inflation concerns.

EARNINGS and ESTIMATES: As of July 3rd, research firm FactSet reported that for Q2 2024, the estimated (year-over-year) earnings growth rate for the S&P 500 was projected to be 8.8%, slightly down from where the estimate stood on March 31st. However, if 8.8% is the actual growth rate, it would mark the highest year-over-year earnings growth for the index since the first quarter of 2022. While eight of the eleven sectors of the index are expected to report growth, four of them are expected to report double-digit earnings growth – Communication Services, Information Technology, Health Care, and Energy. Amplifying these metrics, the forward 12-month price/earnings ratio (P/E) for the S&P 500 is 21.2, which is above the 5-year average (19.3) and above the 10-year average (17.9).

RATES AND THE FED: At the June meeting, the Federal Reserve left the federal funds rate unchanged at the current range of 5.25% to 5.5%, marking the seventh consecutive meeting holding steady rates. This decision keeps the federal funds rate at its highest target range in over 23 years. The Federal Reserve's Chair, Jerome Powell, acknowledged that while inflation had recently slowed and the jobs market had become more balanced, the uncertain economic outlook kept the Fed “highly attentive to inflation risks.” Powell also commented that it “is probably going to take longer to get the confidence that we need to loosen policy” during his press conference. The Fed’s summary of economic projections indicated that the Fed expected one rate cut by the end of 2024, which was down from the three expected at their meeting in March.

Market Performance

Global Stocks

For the 2nd quarter, 20 of the 36 developed markets tracked by MSCI were positive. And of the 40 developing markets tracked by MSCI, 27 were also positive.

- In the U.S., large companies outperformed small companies for the quarter, and growth stocks beat value stocks.

- Only 5 of the 11 S&P 500 sectors delivered positive returns.

- The Technology, Communication Services, and Utility sectors performed best for the quarter, while Consumer Discretionary and Staples added modest gains.

- Materials, Industrials, and the Real Estate sector posted the largest losses among the sectors.

- Developed international market stocks posted minor losses in the second quarter, hurt by a rally in the U.S. dollar – which is a headwind for international stock performance.

- Despite the rally in the Dollar, developing Market stocks delivered positive performance, outperforming relative to U.S. and Developed International stocks for the quarter. Egypt, India, and Taiwan led the way, while China produced a small positive return.

Bonds

The bond market posted a flat return as bond interest rates increased modestly. The highlights include the following:

- The 10-year Treasury bond yield increased by 0.17% for the quarter, leading to modest declines in the U.S. Treasury market as the market continues to reassess expectations of when the Federal Reserve would cut rates.

- Treasury Inflation-Protected Securities outperformed standard Treasuries to post modest positive returns, as inflation expectations remained steady.

- U.S. asset-backed securities delivered solid returns relative to other sectors, given their shorter duration, solid credit fundamentals, and attractive yields.

- Credit spreads, a measure of the bond market's default risk, increased very slightly for the quarter. The highest credit quality bonds provided lower returns than lower credit quality bonds, which have higher income payments due to their inferior credit quality.

- The Municipal market delivered a flat return on par with taxable bond market counterparts as yields on municipal bonds increased slightly more than equivalent maturity Treasury Bonds.